Why Rare Coins Are a Valuable Investment

Unlocking Timeless Value with Rare Coins

Imagine holding a piece of history in the palm of your hand—a rare coin that once passed through the hands of kings, merchants, or adventurers. Beyond their shimmering surfaces, these small treasures carry stories and secrets of bygone eras. But here’s the real magic: rare coins aren’t just relics; they’re an investment that blends passion with tangible value.

Rare coins are like time capsules of wealth. Unlike stocks or bonds that exist only in numbers on a screen, they’re physical assets—ones you can hold, admire, and even pass down to future generations. And their rarity? That’s the golden ticket. As demand for collectibles rises, scarce coins often increase in value, making them a savvy choice for portfolio diversification.

- Tangible beauty: Feel the weight of history in your hands.

- Durable value: Coins resist inflation and market volatility.

- Global appeal: Collectors worldwide cherish these treasures.

For those who adore art, history, and a dash of adventure, investing in rare coins isn’t just smart—it’s exhilarating. Where else can your financial journey also feel like unearthing buried treasure?

Key Factors to Consider Before Investing in Rare Coins

Understanding the Appeal and Value of Rare Coins

Investing in rare coins isn’t just about numbers; it’s a journey into history, artistry, and cultural significance. These coins often carry stories of ancient empires, forgotten rulers, or pivotal moments in time. But before diving into this fascinating world, there are factors you simply can’t ignore.

First, let’s talk **rarity**. Not every old coin is valuable—some are as common as pennies under a couch cushion. Focus on coins with limited mintages or those from periods when production was disrupted by wars or economic instability. These gems tend to retain value better.

Then there’s **condition**. A pristine coin can outshine its tarnished twin, often commanding twice or even ten times the price. Look for coins with sharp details and original luster—professionally graded pieces in higher conditions are often worth the investment.

Key Questions to Ask Before You Buy

To stay ahead, ask yourself:

- Is this coin certified by a trusted grading service like PCGS or NGC? This ensures legitimacy and quality.

- Does the coin fit your investment goals—long-term wealth building or quick returns?

- Am I buying from a reputable dealer? Always look for proven experts with strong reviews.

These questions help you wade through the noise and focus on the coins that are not only priceless but also meaningful. Rare coin investing is part strategy, part passion—so make sure both are fully aligned!

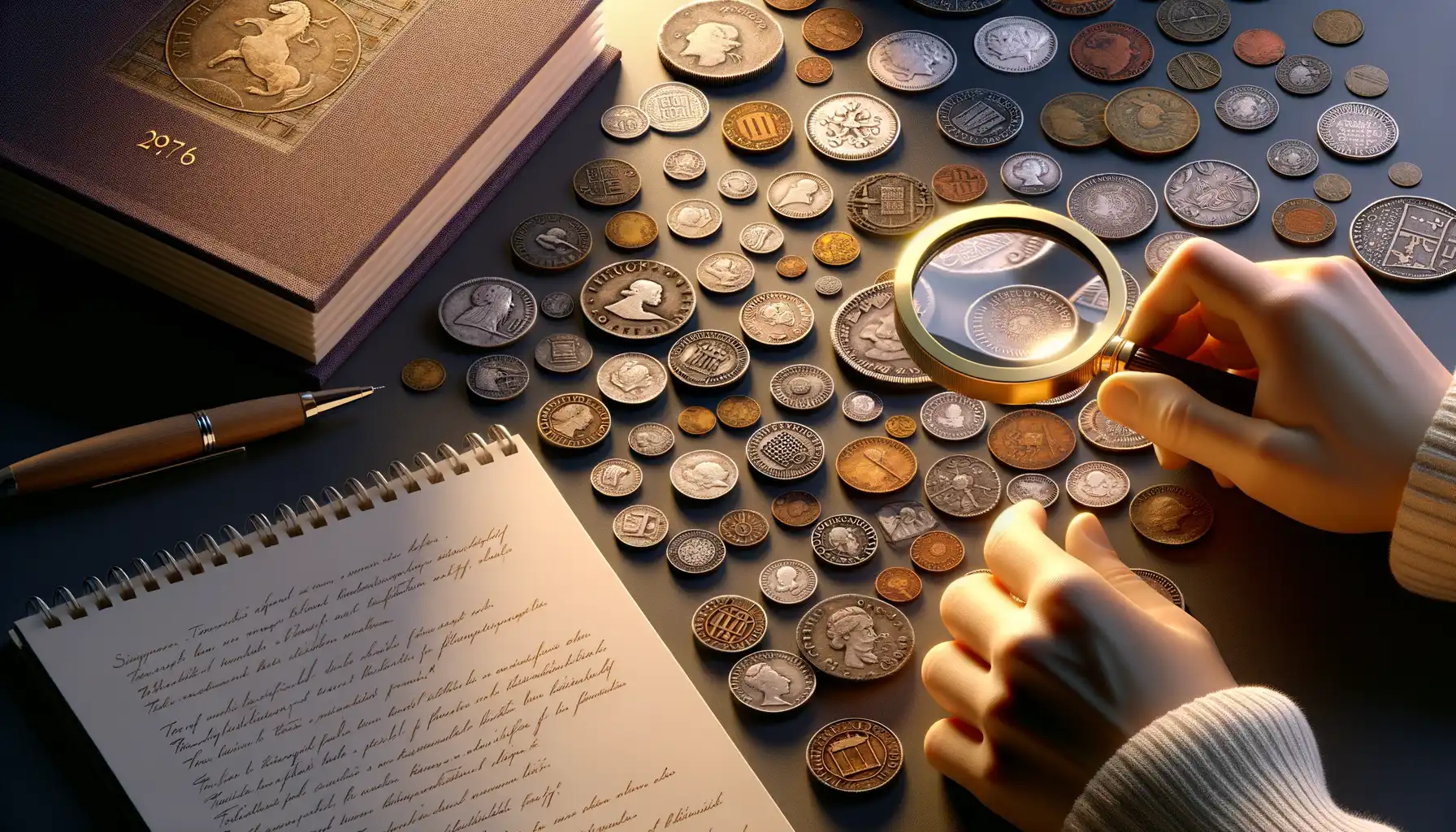

How to Identify and Authenticate Rare Coins

Spotting the Rare Gems: What to Look For

Identifying a rare coin is like being a detective on a treasure hunt—it’s thrilling but requires a sharp eye and a bit of expertise. Start by examining the coin’s **design, date, and mintmark**. These tiny details often hold the key to its rarity. For example, an 1870-S Silver Dollar? That’s no ordinary find—it’s the stuff collectors dream of!

Condition is another huge factor. Coins with minimal wear, known as “mint state”, fetch premium prices. Look for sharp edges, rich toning (a fancy term for the color shift that happens over time), and the absence of scratches or dents. A magnifying glass will be your best friend here—don’t leave home without one!

- Die varieties: Unique errors or design quirks from the mint can skyrocket a coin’s value. Think doubled dates or misplaced letters.

- Provenance: Who owned it before you? Coins with famous or historical ownership tell a story that adds immeasurable charm—and value.

The Art (and Science) of Authentication

Counterfeits are the dark corners of this dazzling world, but you can outsmart them. First, trust your instincts—if the coin feels “off,” it probably is. Second, invest in tools like a scale or caliper to measure weight and size. Rare coins often have precise specifications available in reference books.

And let’s not underestimate the pros. Certified coins graded by organizations such as the Professional Coin Grading Service (PCGS) or Numismatic Guaranty Company (NGC) come with peace of mind. Their seals and holograms are nearly impossible to fake. Trust me, those little slabs of plastic can save you big headaches!

Risks and Challenges of Coin Investing

Unpredictable Market Swings

Rare coin investing isn’t all glitter and gold—sometimes, it’s a stormy sea. The market for rare coins can be as unpredictable as a roulette wheel. Prices may soar one day and plummet the next based on factors like global economic trends, collectors’ demand, or even historical discoveries that make certain coins less unique. For instance, if an unexpected hoard of a “rare” coin is found, what was once highly sought after could lose its shine overnight.

You may think, “I’ll just hold onto my coins until the market rebounds.” And sure, patience is key—but remember, it could take years to see prices recover, and not everyone has that luxury.

The Devil’s in the Details: Scams and Counterfeits

Welcome to the darker side of the numismatic world—where shady sellers and counterfeit coins lurk. Scammers know that rare coins often spark passion, and they prey on investors who are swept up in excitement. Imagine buying what you believe is a genuine 1909-S VDB Lincoln penny, only to discover it’s a cleverly crafted fake. Heartbreaking, right?

Protect yourself by avoiding impulse purchases and sticking with reputable dealers. Here are a few red flags to watch out for:

- Sellers unwilling to provide detailed provenance or certification documents.

- Pressure tactics: legitimate sellers won’t bully you into making rash decisions.

Coin investing can be thrilling, but remember—it’s not immune to risks, and vigilance is your best ally.

Tips for Building a Balanced Rare Coin Portfolio

Choosing Coins That Speak to You

Building a rare coin portfolio isn’t just about numbers; it’s a little like curating an art collection. Yes, value matters—but so do passion and instinct! Start by selecting coins that not only hold investment potential but also spark your interest. Maybe it’s the intricate detail on a 19th-century gold coin or the history of a Roman denarius; let those elements guide you.

Keep in mind: diversity is your secret weapon. Instead of putting all your eggs—or should we say coins?—into one basket, consider varying by era, country, or metal type. A mix of ancient coins, early U.S. currency, and modern commemorative pieces can protect your portfolio from market swings.

Practical Steps to Keep Your Portfolio Balanced

Let’s talk practicalities. How do you actually balance this collection? Here are some tried-and-true tips for a smart strategy:

- Set a clear budget upfront to avoid overspending on that one tempting piece.

- Allocate funds between higher-priced rarities and more affordable, growth-potential coins.

- Revisit your portfolio annually—markets shift, and so might your interests or goals.

- Work with a trusted dealer or numismatic expert for deeper insights.

Remember, building a coin portfolio isn’t a sprint—it’s a marathon. Enjoy the journey, because every new acquisition is a story waiting to be told in your collection.